A Limited Liability Partnership Firm (LLP) is a flexible entity in which every partner's liability equals the contribution he/she makes to the Partnership. There are at least two partners, and such partnerships are formed to spread out risks, have talented individuals as founders, and enjoy division of labour.

One of the most critical LLP Annual Return Filing requirements is Form 11, mandated by the Ministry of Corporate Affairs (MCA) for all LLPs in India—regardless of turnover. This LLP Annual Return Filing ensures transparency by disclosing partner details, contributions, and penalties (if any).

One of the most critical LLP Annual Return Filing requirements is Form 11, mandated by the Ministry of Corporate Affairs (MCA) for all LLPs in India—regardless of turnover. This LLP Annual Return Filing ensures transparency by disclosing partner details, contributions, and penalties (if any).

In this guide, we’ll cover the LLP Annual Return Filing process, deadlines (30 May 2025), required documents, compliance rules, and penalties for late submission

Table of Content

- Latest Updates

- Introduction

- What is Form-11 of LLP Annual Filing?

- Pre-requisites and Documents Requirements

- LLP Compliance Requirements

- Step by Step Process of Filing

- Conclusion

- FAQs

What is Form 11 of LLP Annual Filing?

The Ministry of Corporate Affairs has made the LLP Annual Return Filing compulsory for all LLPs registered and operating in India. It is an annual tax return to be filed by all the LLPs in the country. The LLP form requires you to mention the name, address, and designation of every partner of the LLP. Other than all this, the Form 11 requires you to declare the following :

- Total Contribution by each Partner of the LLP

- Penalties and Compounding Offenses imposed on the Partners

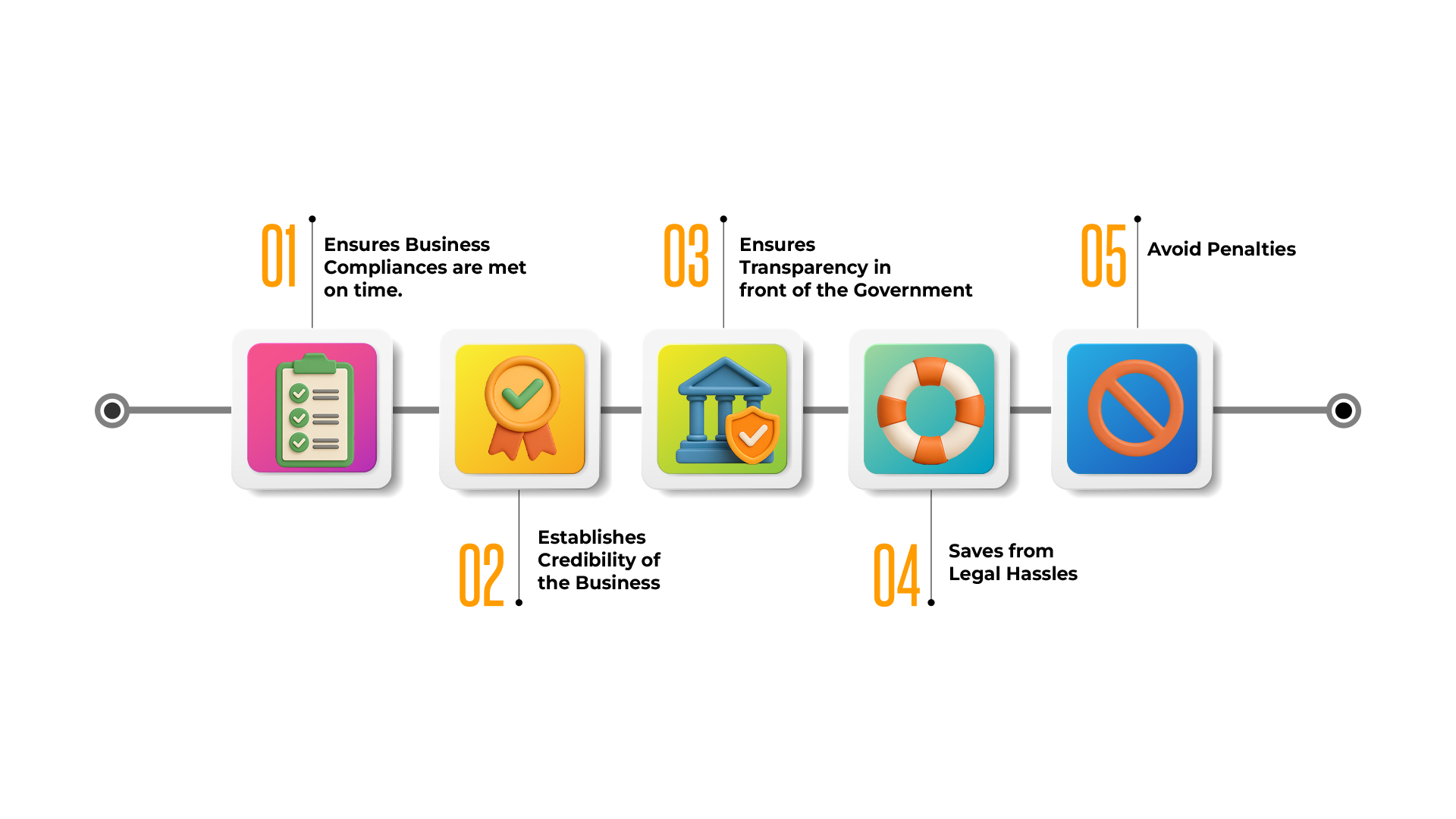

Benefits of LLP Annual Return Filing:-

Pre- Requisites and Documents Required

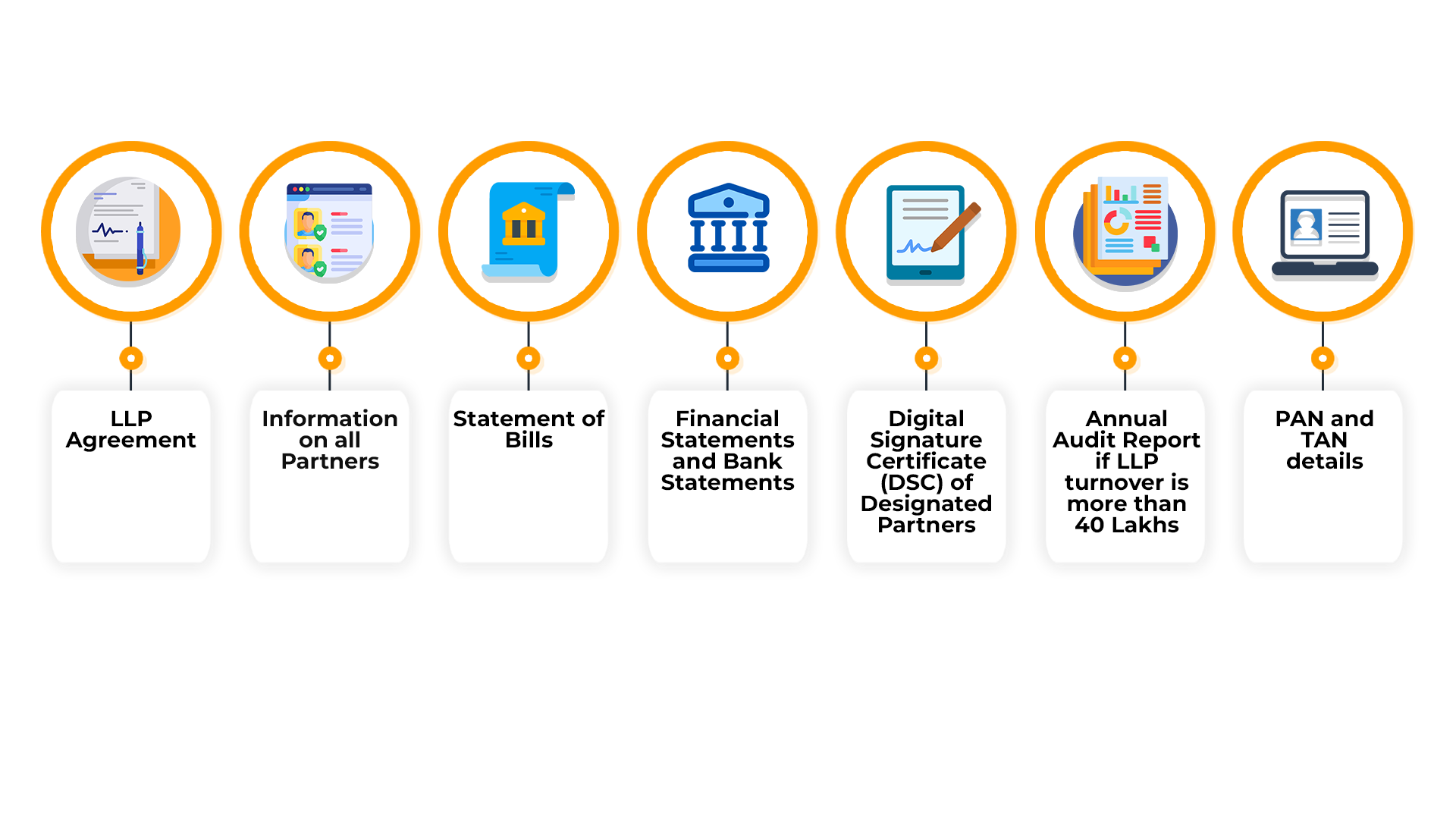

You need some specific data to fulfill LLP compliance requirements. Here, we will discuss the prerequisites and documents required to successfully complete and upload Form 11.

Pre-requisites :-

Documents Needed :-

These are the mandatory documents needed for submitting Form-11. You need to mention the following when submitting the LLP details.

- Details of LLP/Company in which partners/designated partners are/are directors/partners.

- (It is mandatory to attach this detail in case any partner/DP is a partner in any LLP and/ or director in any other company.

LLP Compliance Requirement :-

There are some mandatory but easy-to-follow compliance for Limited Liability Partnership Firms in India. These are as follows-

- Duty of Elected Partner— The elected partner should maintain a Book of Accounts and file an Annual Return with the Ministry of Corporate Affairs (MCA).

- When audit is required— An annual audit is required for an LLP only when the annual turnover exceeds 40 Lakhs or the contribution is more than 25 Lakhs.

- Statement of Account and Solvency— An LLP must file this annual statement within 30 Days from the end of 6 months of the financial year, which is 30 October of each financial year.

- Filing of Annual Return— LLP must undertake it within 60 days from the end of the financial year, which is 30 May of each financial year.

Penalties for Non Compliance :-

Step-by-Step Process to File LLP Annual Return :-

The answer to the question, "How to file LLP Annual Return?" is simple for any business. The government has made an easy-to-fill form, and here are the steps to do it.

Step 1 – Go to the official website - Please download the Form 11 from the website Ministry Of Corporate Affairs - Forms & Downloads

Step 2 – Click the 'Pre-Fill' Button – First, select the 'Year' for which you will file. Then select this year's starting date. Then, fill in your LLPIN in the form. After all this, click on the pre-fill button. By doing this, all details till point 8 will be auto-filled except two points, which you have to fill manually –

- Point 6 – Business Classification

- Point 8(d) – Total contribution received by all partners of the LLP

Step 3 – Details of All (Individual) Partners – Certain details must be filled out for each partner per LLP compliance requirements. These details are –

- Nationality

- Date of Appointment

- Designation History details

- Obligation of Contributions (in rupees)

- Residing in India or Abroad

- Number of LLPs in which they are a partner

Step 4 – Details of Body-Corporate as Partners – In point 11, you must fill in the details of your body-corporate partner, if any. The below information is to be filled in –

- CIN

- FCRN

- LLPIN

- FLLPIN

- Details of the Nominee or Authorized person by the body corporate

Fill All Types of Penalties – In the form, you have to mention the penalties imposed (in any) in the following points-

- Point 13 – Any Penalties imposed on the LLP or any Partner should be discussed here.

- Point 14 – Details of all Compounding Offenses should be addressed here.

Step 5—Mention if LLP Turnover is over 5 Crores- If turnover exceeds rupees 5 Crores annually, click on the 'Yes' button in Point 15.

Attach Documents—Attach the documents as proof of Company and Partner Details. The document list is above in this article.

Step 6—Verification Declaration—After filling out the form, please click on the line 'To the best of my Knowledge……..complete' to declare that the details you provided are correct.

Certification – Two points need to be noted –

(a) Form needs to be certified by a Company Secretary when-

- The total Obligation of Partners exceeds 50 Lakhs

- Turnover of LLP exceeds 5 Crores.

(b) Form needs to be certified by a Designated Partner when –

- Total Obligation of Partners do not exceed 50 Lakhs.

- Turnover of LLP does not exceed 5 Crores.

Step 7—Check Form—When you have filled out all the details in the form, please click on the 'Check Form' button. A pop-up–Window will appear stating, 'Form level pre-scrutiny is successful.

Digital Signature Upload— Once the form is checked, you can upload your Digital Signature.

Step 8– Upload Form on MCA Portal – You must obtain your Login and Password for this official portal.

- Log in to the official MCA Portal

- Now Select 'My Workplace' and upload Form 11 here with your credentials.

Conclusion

The LLP Annual Return Filing is an essential business document and should be completed within the deadline. Abiding by the LLP Compliance Calendar saves your firm from many legal issues and maintains your credibility in front of government authorities.

Legal Window is here to help you with a hassle-free LLP Annual Return Filing in Jaipur (Rajasthan). We will assist you in fulfilling LLP Compliance Requirements in Rajasthan.

For more LLP enquiries contact Legal Window

FAQs

Q1) What happens if you miss the LLP Annual Filing Form 11 deadlines?

If you cannot file your LLP Annual Return Filing by 31 May, then your Limited Liability Partnership (LLP) firm will have to pay a penalty charge of Rs 100 per day. You have to pay this penalty till the time the filing is done.

Q2) Can LLP Annual Returns be filed after the due date?

Yes, you can file the Annual Return after the due date. However, a fine of rupees 100 will be imposed daily until the filing is complete.

Q3) Top 3 best practices in LLP Filing.

The best practices are-

- Keep the Digital Signature Certificate of all Partners of the LLP handy and ready to use

- Do the Annual Return Filing Before the deadline

- Do Audit if LLP turnover exceeds 40 Lakhs annually

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

- Major Upgrade: Breaking Down GST 2.0 September 15, 2025

- New Income Tax Bill 2025 August 27, 2025

- ITR-3 Form Explained: Who Should File & Step-by-Step E-Filing Guide (FY 2024-25) June 25, 2025

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.